Guaranteed term life insurance is like that friend who shows up to the party without an invitation but is welcomed with open arms because they bring snacks. It’s a type of life insurance that doesn’t require you to jump through hoops (or undergo medical exams) to get coverage. For those who might have health issues or just don’t want to deal with the hassle of medical history, this can be a lifesaver—literally!

What is Guaranteed Term Life Insurance?

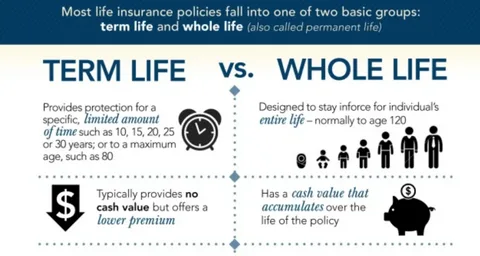

In simple terms, guaranteed term life insurance is a policy that ensures you can get coverage regardless of your health status. Unlike traditional term life insurance, which often asks for a medical exam and a detailed health history (think of it as a first date where you have to share your entire life story), guaranteed term life insurance skips the small talk. You won’t need to answer questions about your cholesterol levels or whether you still think you can run a marathon.

This type of insurance is particularly beneficial for older individuals or those with pre-existing conditions. For example, Mr. Narayan, a 45-year-old college professor, found himself unable to secure a regular term policy due to his medical history. After a chat with a friend, he discovered guaranteed term life insurance and was able to secure coverage without any medical exams. Talk about a win-win situation!

Who Can Get This Insurance?

The beauty of guaranteed term life insurance is its flexibility. Anyone can apply, regardless of their health status. This means that even if you have some serious health issues—like heart problems or diabetes—you’re still eligible. It’s like being invited to a party where everyone is welcome, even if you forgot to wear pants (not that we recommend that!).

However, it’s always wise to check with the insurance provider about specific eligibility criteria. Generally, this type of policy is aimed at individuals aged 50 to 80, but there can be exceptions.

Pros and Cons of Guaranteed Term Life Insurance

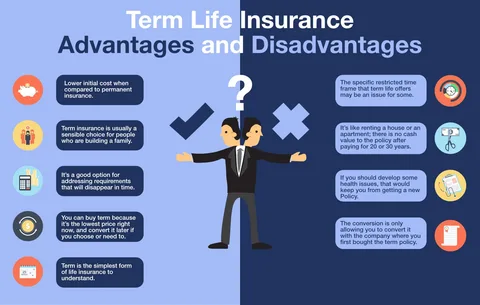

Pros

- No Medical Exams Required: You can skip the doctor’s office, which is a relief for many.

- Accessible for Those with Health Issues: Perfect for those who might be turned away by traditional insurers.

- Fixed Premiums: Your premium stays the same throughout the policy, even if your health gets worse.

Cons

- Higher Premiums: Because insurers are taking on more risk, you might pay more than you would for a regular term policy.

- Lower Coverage Amounts: The death benefits might not be as high as those offered by traditional policies, often only covering final expenses.

- Waiting Period: Many policies have a waiting period of 2 to 3 years during which full benefits are not available. If you kick the bucket during this time, your beneficiaries might only receive a refund of the premiums paid.

How Does It Work?

When you purchase a guaranteed term life insurance policy, you agree to pay premiums for a set period. If you pass away during this time, your beneficiaries receive a death benefit. However, be aware that if you die within the waiting period, they might not get the full amount. It’s like ordering a pizza and finding out it won’t arrive until you’ve already eaten your leftovers.

Conclusion

Guaranteed term life insurance is an excellent option for those who may struggle to get coverage due to health issues. While it might not offer the same benefits as a traditional term life policy, it provides a safety net for your loved ones when you’re no longer around. Just remember to read the fine print—because, like in any good relationship, it’s all about understanding what you’re getting into!

So, if you’re considering guaranteed term life insurance, think of it as a way to ensure your family has a little something to fall back on, even if you can’t run a marathon anymore. After all, life is unpredictable, but your insurance doesn’t have to be!

Citations:

[1] https://www.tataaia.com/blogs/term-insurance/what-is-guaranteed-term-life-insurance.html

[2] https://www.forbes.com/advisor/life-insurance/guaranteed-life-insurance/

[3] https://www.investopedia.com/terms/t/termlife.asp

[4] https://life.futuregenerali.in/life-insurance-made-simple/life-insurance/guaranteed-term-life-insurance/

[5] https://www.bankrate.com/insurance/life-insurance/guaranteed-life-insurance/