When it comes to managing back pain, improving mobility, or simply seeking relief from a long day at work, many people turn to chiropractic care. But here’s the big question: Does insurance cover chiropractic services? Navigating the world of chiropractic care and insurance can be as tricky as finding a needle in a haystack. Don’t worry, though—we’re here to break it all down for you in simple terms, with a dash of humor to keep things light.

In this guide, we’ll explore everything you need to know about chiropractic care and insurance coverage. From understanding what chiropractic care involves to determining how your insurance plan may or may not cover it, we’ve got you covered.

Before diving into insurance details, let’s get on the same page about what chiropractic care actually is. Chiropractic care focuses on diagnosing and treating musculoskeletal disorders, particularly those related to the spine. Chiropractors use hands-on techniques, such as spinal adjustments and manipulations, to help relieve pain, improve function, and support the body’s natural healing processes.

Common Chiropractic Treatments

- Spinal Adjustments: The most well-known chiropractic treatment, which involves manually adjusting the spine to improve alignment and function.

- Soft Tissue Therapy: Techniques used to address issues in muscles, tendons, and ligaments.

- Physical Therapy Exercises: Customized exercises to help improve strength and flexibility.

- Lifestyle and Nutritional Counseling: Guidance on diet, exercise, and lifestyle changes to support overall health and wellness.

Does Insurance Typically Cover Chiropractic Care?

The short answer is: it depends. Chiropractic care coverage varies widely depending on your insurance plan, provider, and location. Here’s a more detailed look at how insurance coverage for chiropractic care typically works:

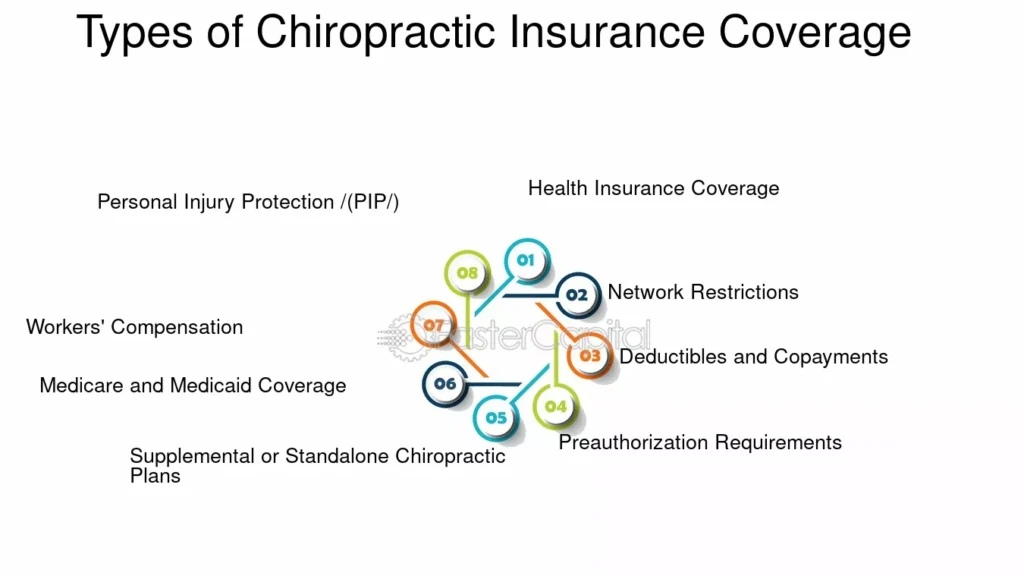

Types of Insurance Plans and Chiropractic Coverage

- Health Insurance Plans: Many traditional health insurance plans offer some level of coverage for chiropractic care. However, the extent of this coverage can vary.

- Medicare: Medicare does cover chiropractic care, but only for spinal manipulations to treat subluxations (misalignments of the spine). It does not cover other chiropractic services such as X-rays or physical therapy.

- Medicaid: Coverage for chiropractic care under Medicaid can vary by state. Some states offer comprehensive coverage, while others provide limited benefits.

- Workers’ Compensation Insurance: If you’re receiving chiropractic care due to a work-related injury, your workers’ compensation insurance may cover the costs.

- Common Coverage Scenarios

- Coverage Limits: Many insurance plans have limits on the number of chiropractic visits they will cover per year.

- Copayments and Deductibles: Even if chiropractic care is covered, you might still be responsible for copayments or meeting a deductible before insurance kicks in.

- In-Network vs. Out-of-Network: Insurance plans often offer better coverage rates for in-network chiropractors compared to out-of-network providers.

How to Find Out if Your Insurance Covers Chiropractic Care

- Review Your Insurance Policy: Check your insurance policy details to see if chiropractic care is included. Look for sections related to alternative therapies or specific chiropractic coverage.

- Contact Your Insurance Provider: Call the customer service number on your insurance card and ask about chiropractic coverage. Be sure to inquire about any limits, copayments, and requirements for referrals.

- Check Your Chiropractor’s Network Status: Verify whether your chiropractor is in-network with your insurance plan. This can help you avoid unexpected out-of-pocket costs.

Steps to Maximize Your Insurance Benefits for Chiropractic Care

- Get Pre-Authorization: Some insurance plans require pre-authorization before you begin chiropractic care. This means you’ll need to get approval from your insurance provider before treatment.

- Keep Detailed Records: Maintain records of all chiropractic visits, treatments, and payments. This can be helpful for tracking expenses and filing claims.

- Ask About Payment Plans: Some chiropractors offer payment plans or sliding scale fees. This can help you manage costs if your insurance coverage is limited.

Cost of Chiropractic Care Without Insurance

If you’re paying out-of-pocket, the cost of chiropractic care can vary based on location, the chiropractor’s experience, and the type of treatment. On average, you can expect to pay between $30 and $200 per visit. Here’s a rough breakdown of potential costs:

- Initial Consultation: $60 to $150

- Follow-Up Visits: $30 to $100 per visit

- X-Rays: $50 to $150 (if not included in the consultation fee)

Conclusion

Navigating insurance coverage for chiropractic care can feel like solving a complex puzzle. However, with a bit of research and understanding, you can figure out how to make the most of your benefits or find alternative ways to manage costs.

Remember, your journey to better health shouldn’t be a stressful one. With the right information and a proactive approach, you can enjoy the benefits of chiropractic care without breaking the bank. So, whether you’re battling back pain or just seeking a bit of relaxation, take charge of your care and your coverage—and keep that smile on your face!

For more details or personalized advice, reach out to your insurance provider or chiropractor. They can provide specific information tailored to your situation.

And always remember: the only thing better than feeling great is not having to worry about how to pay for it. Enjoy your journey to wellness! 🌟